🗓️ Wednesday, Decemeber 17th, 2026

📍 Thailand

🇹🇭💸 Why Thailand Cut Interest Rates in December 2025

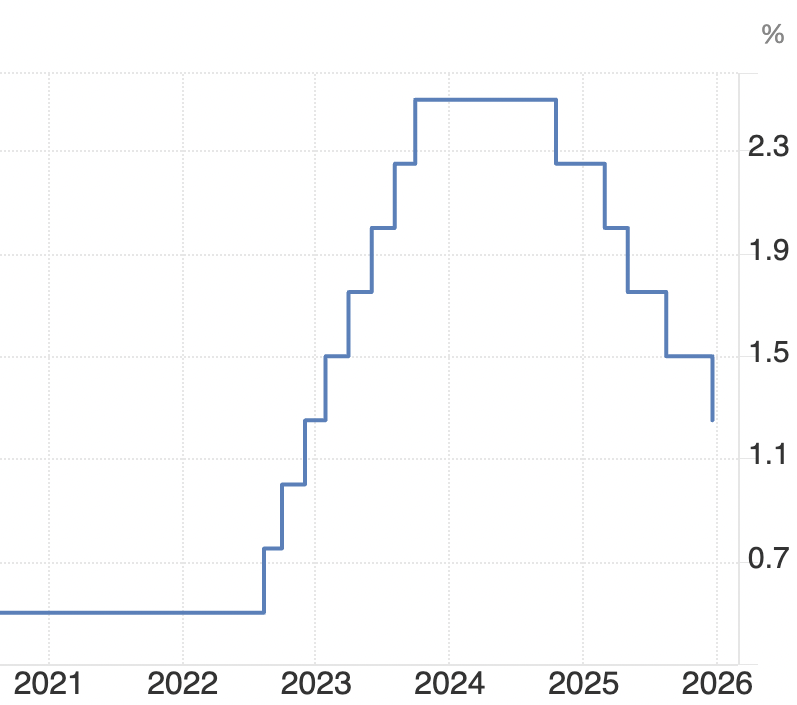

Thailand’s December 2025 interest-rate cut wasn’t random, political, or panic-driven. It was a calculated move based on several quiet warning signs in the economy 🧠. With these pressures still present, further rate cuts remain likely, with the next move likely in early 2026.

Let’s unpack why it happened, what problem it’s trying to fix, and what’s really going on beneath the surface. 👀

🧠 BIG PICTURE FIRST

The Bank of Thailand looked at the economy and thought:

“Growth is weak 📉, prices aren’t rising 🏷️, debt is heavy 💳, and the baht is too strong 💰. If we don’t act now, things could slowly get worse.”

So they made money cheaper 💸 to borrow so it can:

- Encourage spending 🛒

- Reduce financial stress 😌

- Support exports and tourism ✈️🏝️

- Prevent deeper slowdown 🛑

This was preventive medicine, not emergency surgery. 🩺

🔍 THE MAIN REASONS THAILAND CUT RATES

1️⃣ Inflation Was Too Low (This Is a Bigger Deal Than It Sounds)

What people expect: Inflation = bad ❌

Low inflation = good ✅

Reality: Prices barely rising or even falling can be dangerous, as deflation threatens economic growth ⚠️.

In 2025:

- Prices barely rose 📉

- Some categories fell ⬇️

- Inflation stayed below the Bank of Thailand’s comfort zone 😬

Why that scares central banks:

- People delay spending ⏳

- Businesses can’t raise prices 🏭

- Profits shrink 💵

- Wages stagnate 👷♂️

This is how deflation risk starts. 🥶

👉 Hidden nugget: Thailand wasn’t lowering rates because inflation was high 🚫 it was because inflation was too weak to fuel growth 🌱. When inflation runs too high, central banks usually raise interest rates, which has the opposite effect of a rate cut.

2️⃣ Deflation Is the Silent Enemy (Japan Trauma) 🇯🇵

Thailand is extremely cautious about deflation because:

- Japan lost decades of growth to it ⏳

- Once people expect prices to keep falling, they delay spending, which pushes prices down even more and fuels a self-reinforcing cycle 🔄

Why rate cuts help:

- Encourage people to spend now instead of waiting for prices to drop 🛍️

- Make borrowing more attractive 💸

- Gently lift inflation, so people don’t hold off on buying 📈

👉 Important nuance: This cut wasn’t about boosting prices aggressively 🚀 it was about avoiding a deflation mindset 🧊

3️⃣ Economic Growth Was “Soft Everywhere” 🌾

Thailand wasn’t collapsing but growth was:

- Below potential 📉

- Uneven ⚖️

- Too dependent on tourism 🏖️

- Weak in manufacturing 🏭 and private investment 💼

What the Bank saw:

- Businesses hesitant to invest 🤔

- Consumers cautious 🛑

- Credit growth slowing 💳

Lower rates are meant to:

- Improve confidence 💪

- Make investment projects “worth it” again 💼

- Keep employment stable 👷♀️

👉 Hidden nugget: Rate cuts are often about psychology, not just math 🧩

4️⃣ The Thai Baht Was Too Strong (Quiet but Crucial) 💰

The baht was one of Asia’s stronger currencies in 2025 💎

Strong baht = problems:

- Exports get pricier abroad, making Thai goods harder to sell 📦

- Tourists find Thailand expensive, so fewer visitors come 🌴

- Companies earn less when converting foreign income 💵

Lower interest rates:

- Reduce foreign money flowing into Thai bonds 🌐

- Take pressure off the baht 🏋️

- Help exporters and tourism without subsidies 🚢✈️

👉 Under-discussed truth: This rate cut was partly a currency-management tool 🛠️

5️⃣ Household Debt Was Becoming a Growth Anchor 💳

Thailand has high household debt.

Problem:

- People spend more income servicing debt 🏦

- Less money goes into consumption 🛍️

- Growth slows further 🐌

Lower rates:

- Reduce interest burden 💸

- Improve cash flow 💵

- Lower default risk ⚠️

👉 Hidden insight: Rate cuts don’t make people richer 💰 — they make bad situations less damaging 🛡️

6️⃣ Global Central Banks Were Also Cutting 🌍

By late 2025:

- Major economies had shifted toward easing 🏦

- Global inflation pressures cooled ❄️

- Keeping rates too high would attract excess capital 💸

If Thailand didn’t cut:

- The baht could strengthen even more 📈

- Financial conditions would tighten unintentionally 😬

👉 Quiet reality: Monetary policy is partly about not being out of sync with the world 🌐

🧩 THE SIDE EFFECTS

🧠 Nugget #1: Rate Cuts Help Some Debts More Than Others 💳🏠

Home loans benefit more than car loans 🚗

SMEs benefit more than large corporations 🏢

Existing debt relief is uneven ⚖️

Policy feels “weak” to some people 🤏, very strong to others 💪

🏦 Nugget #2: Banks May Not Fully Pass It On 🏦

Banks:

- Lower deposit rates quickly 💰

- Lower loan rates more selectively 🏦

Why?

- Credit risk is rising ⚠️

- Margins are under pressure 📉

👉 Rate cuts don’t guarantee easy credit ✋

📉 Nugget #3: Rate Cuts Can Hide Structural Problems ⚠️

Lower rates:

- Support weak businesses 🏭

- Delay necessary restructuring 🔄

- Reduce urgency for reform 🛠️

Rate cuts buy time — they don’t fix fundamentals ⏳

💰 Nugget #4: Savers Quietly Pay the Price 🪙

Lower rates:

- Reduce income for retirees 👴👵

- Push savers into riskier assets ⚡

- Slowly redistribute wealth toward borrowers 🔄

📊 Nugget #5: Asset Prices React Faster Than the Economy 💹

When interest rates are lowered, some things tend to rise quickly. Financial markets often react immediately, sometimes even getting ahead of the cuts:

- Stocks 📈

- Property 🏘️

- Financial assets 💳

Meanwhile, the “real economy” takes its time to catch up:

- Wages 💵

- Productivity ⚙️

- Living standards 🏠

Lower rates eventually boost these too, but it takes time for households and businesses to feel the effects.

This creates a gap between market optimism and daily life 🌉

📉 Interest Rate Effects: What Goes Up and What Goes Down 💹

When Central Banks changes interest rates, it affects every part of the economy. Here’s a simple breakdown:

💸 When Interest Rates Drop ⬇️

- Borrowing & Loans 💳: Cheaper to take loans for homes, cars, or businesses as borrowing is cheaper.

- Spending & Consumption 🛍️: People are more likely to spend money now rather than save as savings get less interest.

- Investment 📈: Businesses find new projects more attractive because borrowing is cheaper.

- Exports & Tourism 🌴: A slightly weaker currency makes goods more affordable overseas and more attractive to tourists, boosting exports and visitor spending.

- Asset Prices 💹: Stocks, property, and other investments tend to rise as investors look for better returns than low bank interest.

📉 What Goes Down When Rates Drop ⬇️

- Savings Income 🪙: Bank deposits and fixed-income returns fall, hitting savers and retirees.

- Currency Strength 💰: Foreign investors may put less money into bonds, causing the currency to weaken.

- Loan Costs for Banks 🏦: Banks earn less on lending, which can tighten credit if they don’t pass cuts fully to borrowers.

🔄 Why This Happens

Lower interest rates make borrowing cheaper and saving less rewarding. This encourages people to spend and invest more, which supports economic growth. At the same time, savers earn less, and banks’ profit margins may shrink.

🧠 THE DEEP TRUTH

Thailand cut interest rates in December 2025 not because things were terrible, but because several quiet warning lights were on at the same time: low inflation flirting with deflation 🧊, soft growth 🐌, heavy household debt 💳, a too-strong currency 💰, cautious banks 🏦, and a global shift toward easier money 🌍. The goal wasn’t to spark a boom 🚀 — it was to prevent a slow slide into stagnation ❄️

🧭 Final Takeaway

Rate cuts are not about making the economy fast 🏃♂️💨. They’re about keeping it from freezing ❄️🛑